As an integral part of the electrical energy production market, the day-ahead market, also called single day-ahead coupling (SDAC), aims to carry out electrical energy transactions by submitting selling and takeover bids for electrical energy on behalf of the market agents for the twenty-four hours of the following day. This market, coupled with Europe since 2014, is one of the crucial pieces in achieving the objective of the European Internal Energy Market.

Every day of the year at 12:00 CET is the day-ahead market session where prices and electrical energies are set for all across Europe for the twenty-four hours of the next day. The price and volume of energy at a specific hour are established by where supply and demand intersect, following the model agreed upon and approved by all of the European markets that is currently applied in Spain, Portugal, Germany, Austria, Belgium, Bulgaria, Croatia, Slovakia, Slovenia, Estonia, France, Holland, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Finland, Sweden, Denmark, Norway, Poland, the Czech Republic, and Romania.

The buying and selling agents that are found in Spain or Portugal will present their bids to the day-ahead market through OMIE, which is the only NEMO in those countries. Their buying and selling bids are accepted based on their economic merit and depending on the available capacity for interconnection between price zones. If, at a certain time of day, the capacity for interconnection between two zones is sufficient to allow the flow of electricity resulting from negotiation, the price of electricity at that time will be the same in both zones. If, on the other hand, interconnection at that time is maxed out, at that moment the algorithm for setting prices results in a different price in each zone. The mechanism described for setting electricity prices is called market coupling.

The results from the day-ahead market, based on free contracting between buying and selling agents, represent the most efficient solution from an economic point of view, but given electricity's characteristics, it is also necessary for it to be viable from a physical point of view. As such, once these results are obtained, they are sent to the System Operator for validation with perspective on their technical viability. This process is known as managing the system's technical limitations and ensures that the market results can be technically accommodated on the transportation network. As such, results from the day-ahead market may be altered slightly as a result of the analysis of technical limitations done by the System Operator, giving rise to a viable daily program.

PRICE LIMITS AND NOTIFICATION AND PRICE THRESHOLDS

Harmonised maximum and minimum clearing prices for the Single Day-Ahead Coupling

The following initial values are established as maximum and minimum price limits for the Day-ahead market in the MIBEL zone (Spain and Portugal):

- The reference harmonised maximum clearing price for SDAC shall be +4000 EUR/MWh.

- The reference harmonised minimum clearing price for SDAC shall be -500 EUR/MWh

Notification Thresholds limits for the Single Day-Ahead Coupling

The following initial values are established as maximum and minimum notification thresholds for Day-ahead market in the MIBEL zone (Spain and Portugal):

- Maximum Notification Thresholds +200 EUR/MWh

- Minimum Notification Thresholds -20 EUR/MWh

The intraday european markets are an important tool that allows market agents to adjust the day-ahead market's resulting schedule by submitting selling and takeover bids for energy, according to expected needs in real-time.

The intraday markets are currently structured into three bidding sessions in Europe's scope and a continuous cross-border European market, and they are carried out once the system operator has made the necessary adjustments after the day-ahead market so that the resulting schedule may be viable.

Just like the day-ahead market, once these markets are done, the results are sent to system operators so that they can schedule the balancing processes.

PRICE LIMITS AND NOTIFICATION AND PRICE THRESHOLDS

Harmonized maximum and minimum clearing prices for SIDC

The following initial values are established as maximum and minimum price limits for the intraday markets in the MIBEL zone (Spain and Portugal):

- The harmonized maximum clearing price for SIDC shall be +9999 EUR/MWh.

- The harmonized minimum clearing price for SIDC shall be -9999 EUR/MWh.

Notification Thresholds limits for the intraday auction market.

The following values are established as price notification thresholds for intraday market offers in the MIBEL zone (Spain and Portugal):

- Maximum price notification threshold for the intraday auction market: +200 EUR/MWh.

- Minimum price notification threshold for the intraday auction market: -20 EUR/MWh.

Notification Thresholds limits for the intraday continuous market

The following values are established as price notification thresholds in the continuous intraday market in the MIBEL area (Spain and Portugal):

- Maximum price notification threshold for the intraday continuous market: +1.500 EUR/MWh.

- Minimum price notification threshold for the intraday continuous market: -150 EUR/MWh.

The intraday european markets are composed of the intraday market of auctions coupled at European level (Intraday Capacity Auctions -IDA-) and the continuous intraday market whose purpose is to meet the energy supply and demand that may occur, coupled with the management of the international interconnections of the different price zones involved in the European market coupling, after the Final Daily Viable Program (PDVD) has been set.

The European intraday auction market is currently structured in three sessions with different scheduling horizons for each session. In these markets the volume of energy and the price for each hour are determined by the intersection between supply and demand, the model being agreed and approved by all European markets.

The purpose of the intraday auction market is to meet, through the submission of bids for the sale and purchase of electricity by market agents, the adjustments to the Definitive Viable Daily Program, the scheduling basis of which is the result of the daily market.

The intraday auctions, like the daily market, follow the marginalist model and the market coupling model for the borders it manages.

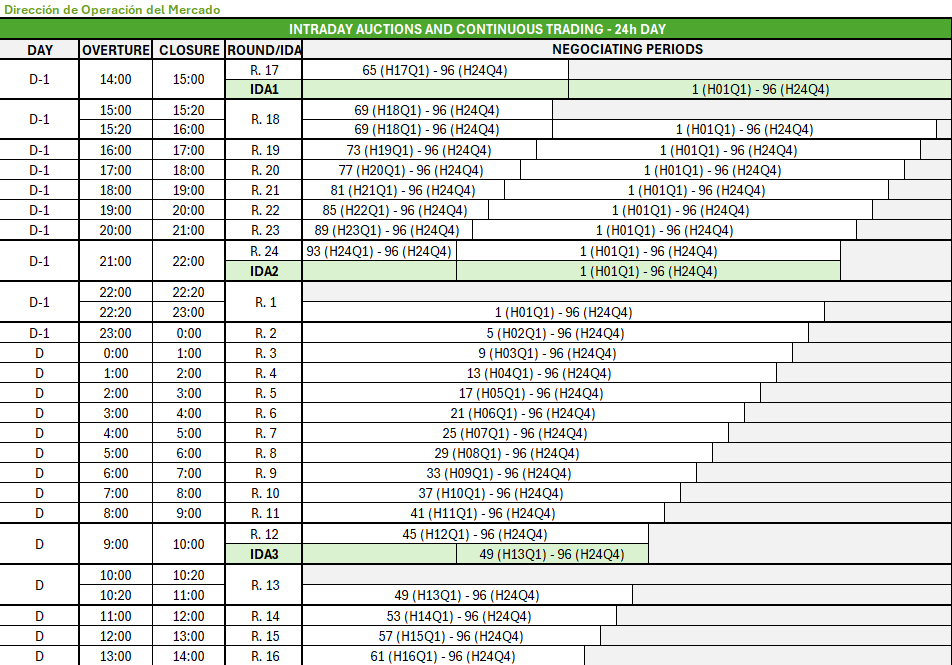

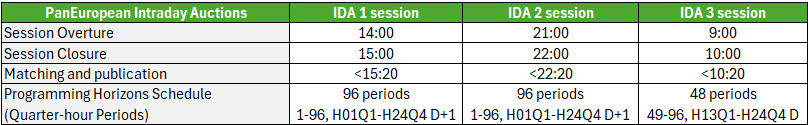

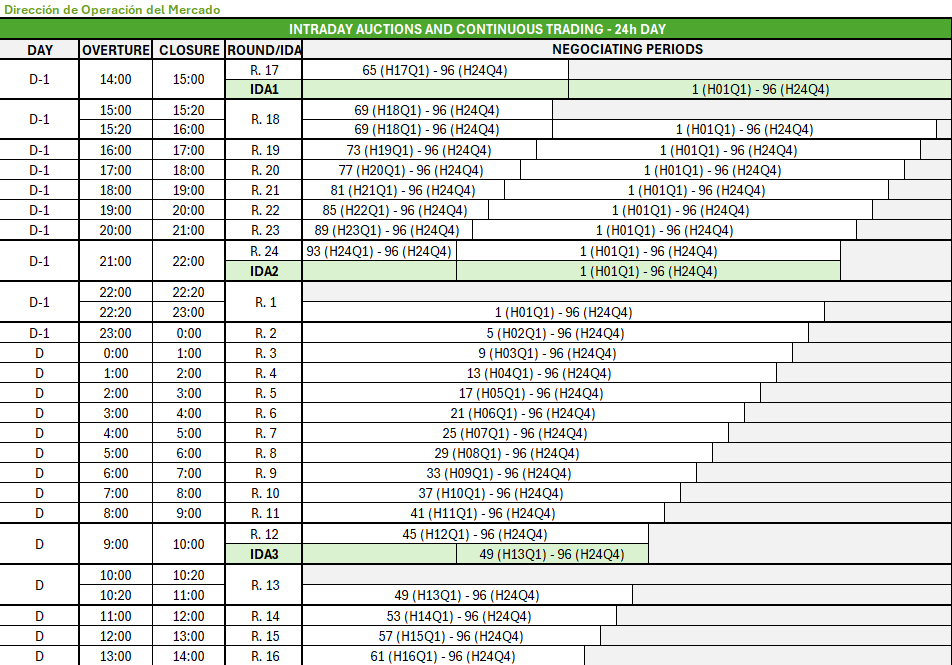

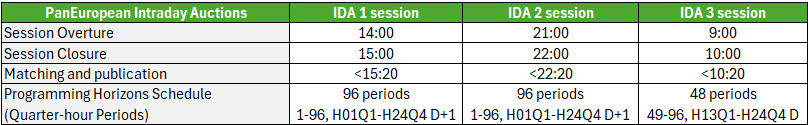

The intraday auction market is currently structured in three sessions with the following distribution of schedules per session:

Twenty minutes before the close of each session, cross-border trading in the continuous intraday market will be interrupted for contracts that fall within the auction horizon, allowing local trading of these periods until the close of bid reception for the session.

Like the intraday auction market, the intraday continuous market, also called single intraday coupling (SIDC), gives market agents the change to manage their energy imbalances with two fundamental differences with regard to the auction:

- In addition to gaining access to market liquidity at the local level, agents can benefit from the liquidity available in markets in other areas of Europe, given that cross-border transportation capacity is available between the zones.

- The adjustment can be made up to one hour before the moment of delivery.

The purpose of this market is to facilitate the trade of energy between different areas of Europe continuously and to increase the global efficiency of transactions on the intraday markets across Europe.

The opening of the negotiation of all contracts of the intraday continuous market for the next day (D + 1), in the price areas of Spain and Portugal will be made after the end of the first auction of the current day (D) , provided the system operator has published the Definitive Viable Daily-ahead Schedule for the following day (D + 1) previosly. The following table shows by day, period and time the contracts in negotiation:

The intraday european markets are composed of the intraday market of auctions coupled at European level (Intraday Capacity Auctions -IDA-) and the continuous intraday market whose purpose is to meet the energy supply and demand that may occur, coupled with the management of the international interconnections of the different price zones involved in the European market coupling, after the Final Daily Viable Program (PDVD) has been set.

The European intraday auction market is currently structured in three sessions with different scheduling horizons for each session. In these markets the volume of energy and the price for each hour are determined by the intersection between supply and demand, the model being agreed and approved by all European markets.

The purpose of the intraday auction market is to meet, through the submission of bids for the sale and purchase of electricity by market agents, the adjustments to the Definitive Viable Daily Program, the scheduling basis of which is the result of the daily market.

The intraday auctions, like the daily market, follow the marginalist model and the market coupling model for the borders it manages.

The intraday auction market is currently structured in three sessions with the following distribution of schedules per session:

Twenty minutes before the close of each session, cross-border trading in the continuous intraday market will be interrupted for contracts that fall within the auction horizon, allowing local trading of these periods until the close of bid reception for the session.

Like the intraday auction market, the intraday continuous market, also called single intraday coupling (SIDC), gives market agents the change to manage their energy imbalances with two fundamental differences with regard to the auction:

- In addition to gaining access to market liquidity at the local level, agents can benefit from the liquidity available in markets in other areas of Europe, given that cross-border transportation capacity is available between the zones.

- The adjustment can be made up to one hour before the moment of delivery.

The purpose of this market is to facilitate the trade of energy between different areas of Europe continuously and to increase the global efficiency of transactions on the intraday markets across Europe.

The opening of the negotiation of all contracts of the intraday continuous market for the next day (D + 1), in the price areas of Spain and Portugal will be made after the end of the first auction of the current day (D) , provided the system operator has published the Definitive Viable Daily-ahead Schedule for the following day (D + 1) previosly. The following table shows by day, period and time the contracts in negotiation: