Market participants regularly adjust the number and amount of the payment collateral they need to operate in the market, to cover fluctuations in the price of electricity, and to adjust them to their energy purchase forecasts; along with the renewal of that collateral by expiry of their validity, this gives rise to a significant volume of collateral exchanges made by the agents.

In its commitment to digitalization, OMIE has designed and implemented an innovative collateral model in XML format, fully digital and standardized, that can be used widely by financial institutions; it replaces traditional documented collateral, in paper format (with a handwritten signature) or even other less advanced digital formats (such as the PDF with a digital signature).

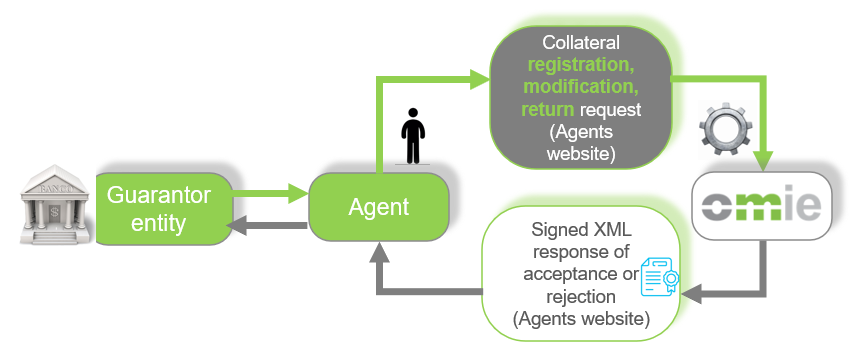

- The implemented process covers the entire life cycle of the collateral (registration, modification, cancellation, etc...).

- It also allows the formalization of surety bonds(1) in an electronically signed XML format.

- The electronic signature must be made with certificates from a representative of the guarantor entety.

- OMIE has made the template models and schemas for their implementation available to guarantor entities.

- Implementation by the entities is simple, as they can issue this collateral format based on the published models, even without any type of development by the entity using signature tools published by the Spanish government.

(1) Soon available

This collateral model in XML format has been warmly received by agents, who have chosen to use this new feature that OMIE has made available to them, as it provides the following advantages:

- Reduction of errors: The use of a standard format avoids errors in the formalization of the collateral due to changes in the established model.

- The exchange process is simplified since the agent attaches the XML collateral to the collateral REGISTRATION or MODIFICATION request through the market website, without the need to fill out any form.

- Automated processing: as it is an automatically treatable format, no manual verification is required by OMIE.

- Time reduction: in case of acceptance, the guaranteee immediately becomes part of the collateral available to the agent to operate in the market.

- The market rules allow shorter minimum term periods for this type of collateral because it is an automated format (minimum validity of 1 month).

Currently, the largest national banking entities are already issuing guarantees in XML format: